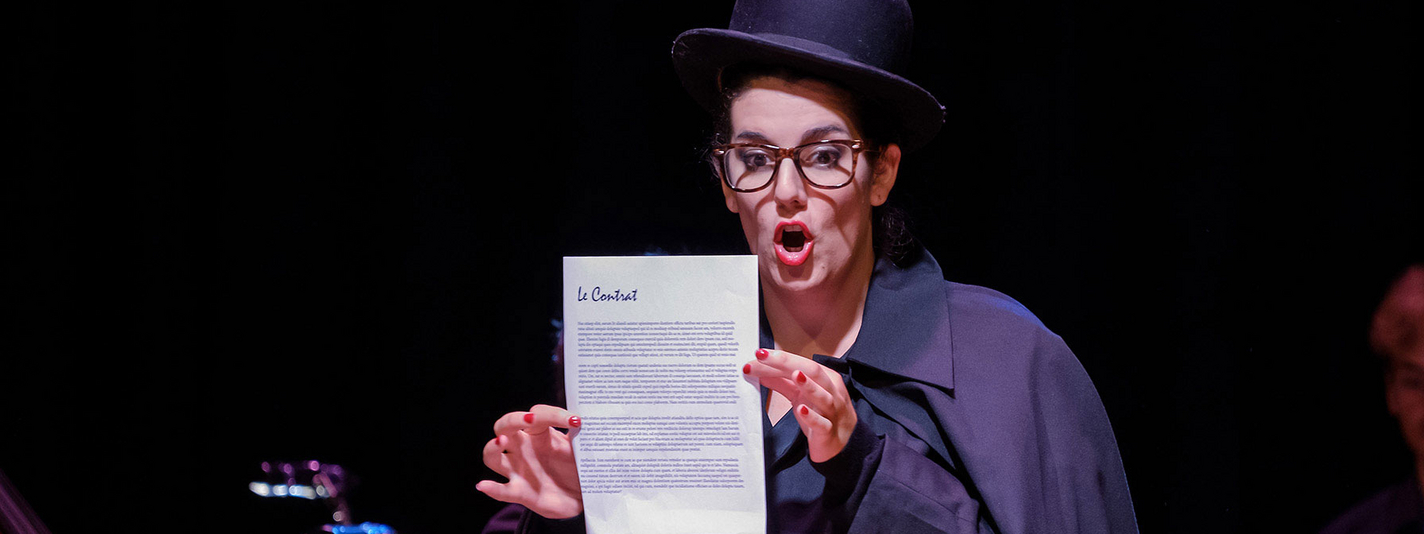

Employment contract

You are an employee if you work for someone else (an employer), for a monthly salary, during agreed working hours per week, do a certain job and you do it yourself.

Checklist

The employer is legaly ‘the boss’: in the end you are hired for a certain job and your employer can tell you what to do and how to do it. Obviously some jobs require (artistic) freedom.

Oral agreements are valid but difficult to prove. Make sure you have the agreements in writing before you start working.

- Who is your employer?

Who exactly is employing you? Is your employer a person at law or a natural person? - What is your position?

What are your duties and responsibilities, what needs to be your 'performance'. - Wat are the financial agreements?

Agree on gross salary, pension arrangements and expenses. - Working hours and holiday?

Will you work full time or part time, how many hours per week? And what is your holiday entitlement. - Fixed-term or permanent contract?

This is important to know regarding unemployment benefits. Don't forget the probationary period. If you have a few fixed-term contracts in a certain period, it can (by law) become a permanent contract. - What collective labour agreement, if any, is applicable?

A collective labour agreement contains pay scales and sometimes different arrangements about how many fixed-term contracts are allowed before it will be legally considered a permament contract. - Does your employer want to set up rules about other work?

Are you allowed to take on other jobs? Or work for yourself?

Directly to:

Differences between employee and contractor

The employee:

- is still entitled to a salary when he is ill,

- may apply for benefits such as unemployment (WW) and incapacity (WIA) benefits,

- is only liable for causing damage to the employer, collegues or others in case of intention or serious misconduct,

- is protected in case of accidents and occupational diseases. The employer has to pay for damage,

- is entitled to a safe working environment because of the 'safety at work act' (Arbowet),

- will receive a net salary, the employer will deduct the wage tax from the gross salary,

- cannot be dismissed 'just like that', the law is meant to protect employees.